The Cyprus IP regime

- Yossi Elmaliach, CPA

- Sep 14, 2021

- 4 min read

Cyprus is an attractive location for the establishment of an IP holding and development company, offering an efficient tax rate as well as the legal protection afforded by EU Member States and by the signatories of all major IP treaties and protocols.

Background

Cyprus IP regime is fully compliant with international developments in the tax treatment of IP income and OECD’s guidance. The IP regime has been reviewed by the EU Code of Conduct and has been assessed as fully compatible with EU standards.

Benefits of the Cyprus IP regime

80% of the profits qualifying for the regime are exempt from tax. With a corporate tax rate of 12.5%, this can result in an effective tax rate of as low as 2.5%.

Relevant details of the regime

Under the Cyprus IP regime, 80% of the qualifying profits generated from the qualifying assets is deemed to be a tax deductible expense for qualifying taxpayers. In calculating the qualifying profits, the new regime adopts the ‘Nexus’ approach.

According to this approach, the level of the qualifying profits is positively correlated to the extent the claimant performs R&D activities to develop the qualifying asset (QA) within the same company.

Qualifying assets

Qualifying assets under the new regime include:

• patents

• copyrighted software programs, and

• other intangible assets that are non-obvious, useful and novel.

Qualifying assets do not include trademarks and copyrights.

Qualifying persons

Qualifying persons include Cyprus tax resident taxpayers, tax resident Permanent Establishments (PEs) of non-tax resident persons as well as foreign PEs that are subject to tax in Cyprus.

Qualifying profits

Qualifying profits are calculated in accordance with the nexus fraction that follows.

The nexus fraction

The nexus fraction is used to determine the amount of qualifying profits that will give the relevant deduction to the taxpayer.

Overall Income (OI)

The overall income (OI) is calculated as the gross income less any direct expenditure (including the capital allowances) of this asset, i.e. the gross profit. Overall income includes, but is not limited to, royalties received for the use of the intangible asset, trading income from the disposal of qualifying asset and embedded income earned from the qualifying asset.

Capital gains arising from the disposal of a QA are not included in the overall income and are fully exempt from tax.

Qualifying Expenditure (QE)

The qualifying expenditure includes salary and wages, direct costs, general expenses associated with R&D activities and R&D expenditure outsourced to unrelated parties.

The QE does not include any acquisition costs of the IP, interest paid or payable, any amounts payable to related persons carrying out R&D and costs which cannot be proved to be directly associated with a specific QA.

Uplift Expenditure (UE)

The up-lift expenditure (UE) is the lower of:

• 30% of the QE and

• The total acquisition cost of the QA and any R&D costs outsourced to related parties.

Overall Expenditure (OE)

The overall expenditure (OE) is the sum of:

• The qualifying expenditure and

• The total acquisition costs of the QA and any R&D costs outsourced to related parties incurred in any tax year.

Cumulative nexus fraction

The nexus approach is an additive approach; the calculation requires both that QE includes all qualifying expenditures incurred by the taxpayer over the life of the IP asset and that OE includes all overall expenditures incurred over the life of the IP asset.

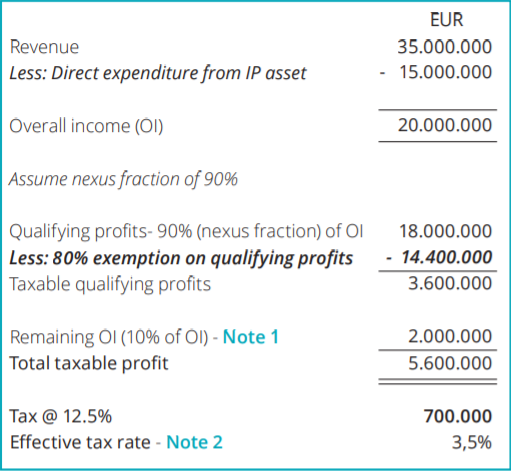

Illustrative example

Once the nexus fraction is calculated, this will be used to determine the deduction available for each QA, as illustrated in the example

Note 1: The remaining overall income is added to the taxable qualifying profits and the total is subject to tax at the corporate tax rate of 12.5%

Note 2: The effective tax rate can be reduced to 2.5% with a nexus fraction of 100%

Losses from the qualifying assets

Where the calculation of qualifying profits results in a loss, only 20% of this loss may be carried forward or group relieved.

Disposal of an IP

When an IP asset is disposed, an accounting profit/loss may arise. As long as the disposal is considered as a capital nature transaction, the accounting gain/loss should be exempt from tax in Cyprus. Where the disposal is considered as a trading nature transaction, the accounting gain/loss should be taxable.

Up to 31 December 2019, upon the disposal of an IP asset, the taxpayer would also be obliged to prepare a balancing statement to calculate the taxable gain/loss as follows: Disposal proceeds less tax written down value of the asset (TWDV), whereby TWDV is the cost of the IP asset less accumulated capital allowances claimed.

As of 1 January 2020, taxpayers disposing their IP assets have no obligation to prepare a balancing statement. Therefore a (capital nature) disposal of an IP asset, should not trigger any Cyprus tax implications.

Income from non-qualifying intangible assets

Income arising from non-qualifying intangible assets that are used in the business, can still benefit from certain provisions of the Cyprus tax law. In particular, capital allowances and/ or notional interest deduction (NID) may be available to be deducted from such income, which should help reduce the overall effective tax rate of the company. Examples of such intangible assets include trademarks, copyrights and other IP assets.

Capital allowances

All intangible assets (excluding goodwill), irrespective of whether they are qualifying assets or not, are eligible for tax amortization (capital allowances) over their useful economic life with a maximum of 20 years.

The taxpayer has the option not to claim capital allowances in a given year. Moreover, capital allowances that have not been claimed in a year are claimed over the remaining useful life of the asset.

Notional Interest Deduction (NID)

NID may be available on assets introduced in a Cyprus company through equity which are employed in the production of taxable income. More information on NID is available in our dedicated NID publication.

Contact us

Yossi Elmaliah, Founder of FinPro house of Finance

www.finpro.com.cy

Ye@finpro.com.cy

Comments